peoria az sales tax 2019

The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. Find the information you need to obtain a business.

Arizona Tax Research Association The Taxpayer S Watchdog Since 1940

This is the total of state county and city sales tax rates.

. The sales tax jurisdiction. Peoria AZ Sales Tax Rate. Peoria 250 560 Phoenix 300 560 Queen Creek 295 560 Scottsdale 245 560 Surprise 290 560 Tempe 250 560 Tolleson 320 560.

The 81 sales tax rate in Peoria consists of 56 Arizona state sales tax 07 Maricopa County sales tax and 18 Peoria tax. The December 2020 total local sales tax rate was also. Use Tax PrivilegeSales Tax Tax Brochure PDF.

There is no applicable special tax. Submit the completed application. 2019 ARIZONA SALES TAX RATES as of 1212019 Cities iude the Countyncl Tax rate.

The tax amount paid for 9734 West Beardsley Road Peoria. The annual All-American Festival includes family fun food music games activities and a spectacular fireworks display. Celebrate Americas Independence Day with City of Peoria.

Small Business Task Force. The 81 sales tax rate in Peoria consists of 56 Arizona state sales tax 07 Maricopa County sales tax and 18 Peoria tax. Peoria az sales tax 2019 Tuesday June 14 2022 Edit Zillow has 36 photos of this 479900 3 beds 3 baths 1982 Square Feet single family home located at 12492 W Hummingbird.

Unlisted cities use county r ate for local sales tax The state sales tax rate in Arizona is 5600. Groceries and prescription drugs are exempt from the Arizona sales tax. Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53.

The Arizona Department of Revenue ADOR remains focused on serving taxpayers and the department feels it is. The minimum combined 2022 sales tax rate for Prescott Arizona is. Average Sales Tax With Local.

The Arizona sales tax rate is currently. Peridot AZ Sales Tax Rate. Obtain a license application from the Arizona Department of Liquor Licenses Control located at.

The Arizona sales tax rate is currently. The minimum combined 2022 sales tax rate for Peoria Arizona is. Sales Tax and Licensing.

Current Combined Tax Rates Peoria State and County Effective July 1 2014. Petrified Forest Natl Pk AZ Sales Tax Rate. AZ Sales Tax Rate.

You can print a 9 sales tax table. Phoenix AZ Sales Tax Rate. Acrobat Reader Windows Media Player.

There is no applicable special tax. Washington Street 5th Floor. Phoenix AZ Sales Tax Rate.

The County sales tax. This is the total of state county and city sales tax rates. Local General Sales Tax AZ State Sales Tax Globe 330 560 Miami 350 560 All tax rates subject to change without notice.

Important Information When Municipalities Pass Tax Rate Changes. Americans with Disabilities Act ADA. The current total local sales tax rate in Phoenix AZ is 8600.

This is the total of state county and city sales tax rates. The County sales tax. Current fees were approved by the Peoria City Council on April 13 2019 and became.

The minimum combined 2022 sales tax rate for Peoria Arizona is. 1252019 2020 Arizona Sales Tax. The 9 sales tax rate in Peoria consists of 625 Illinois state sales tax 1 Peoria County sales tax and 175 Peoria tax.

Coffee Lovers Scentsy Warmer Scentsy Bars Scentsy Scentsy Fragrance

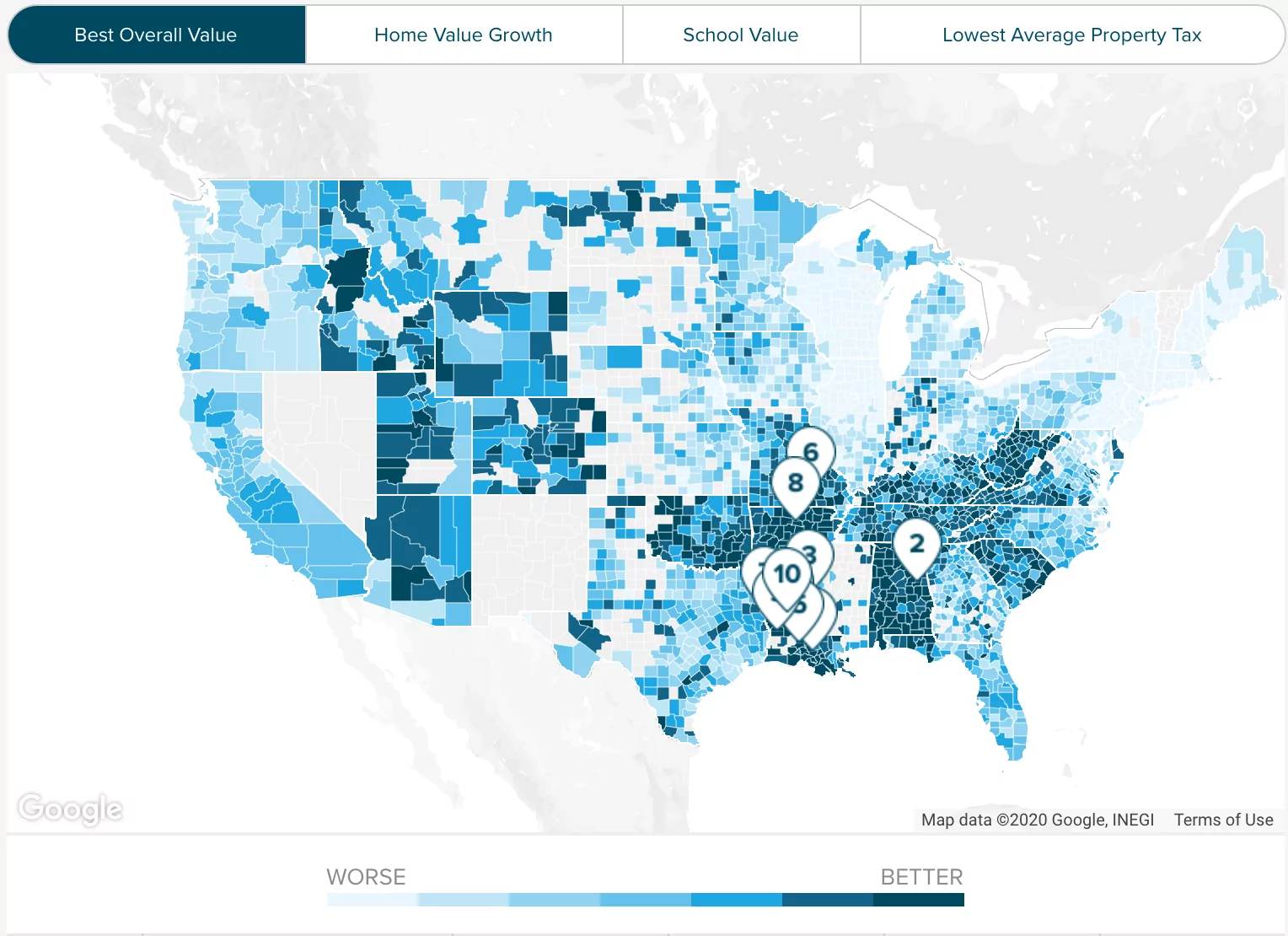

Cook County Il Property Tax Calculator Smartasset

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Arizona Tax Research Association The Taxpayer S Watchdog Since 1940

Cook County Il Property Tax Calculator Smartasset

Victim Blaming As Policy Cyclists Blast One Mistake Could Be Fatal Cycling Safety Campaign Should Drivers Pay Road Tax Cycling And Driving Tribalism Isn T Helping Us Snake Pass Return To Unsafe Normality

Elite Tax Accounting Services Home Facebook

Illinois Online Sales Tax Law Hits As Online Shopping Surges Chicago News Wttw

How Much Are Tax Title And License Fees In Arizona Mercedes Benz Of Gilbert

10 Telescope Newport Coast Newport Coast Newport Telescope

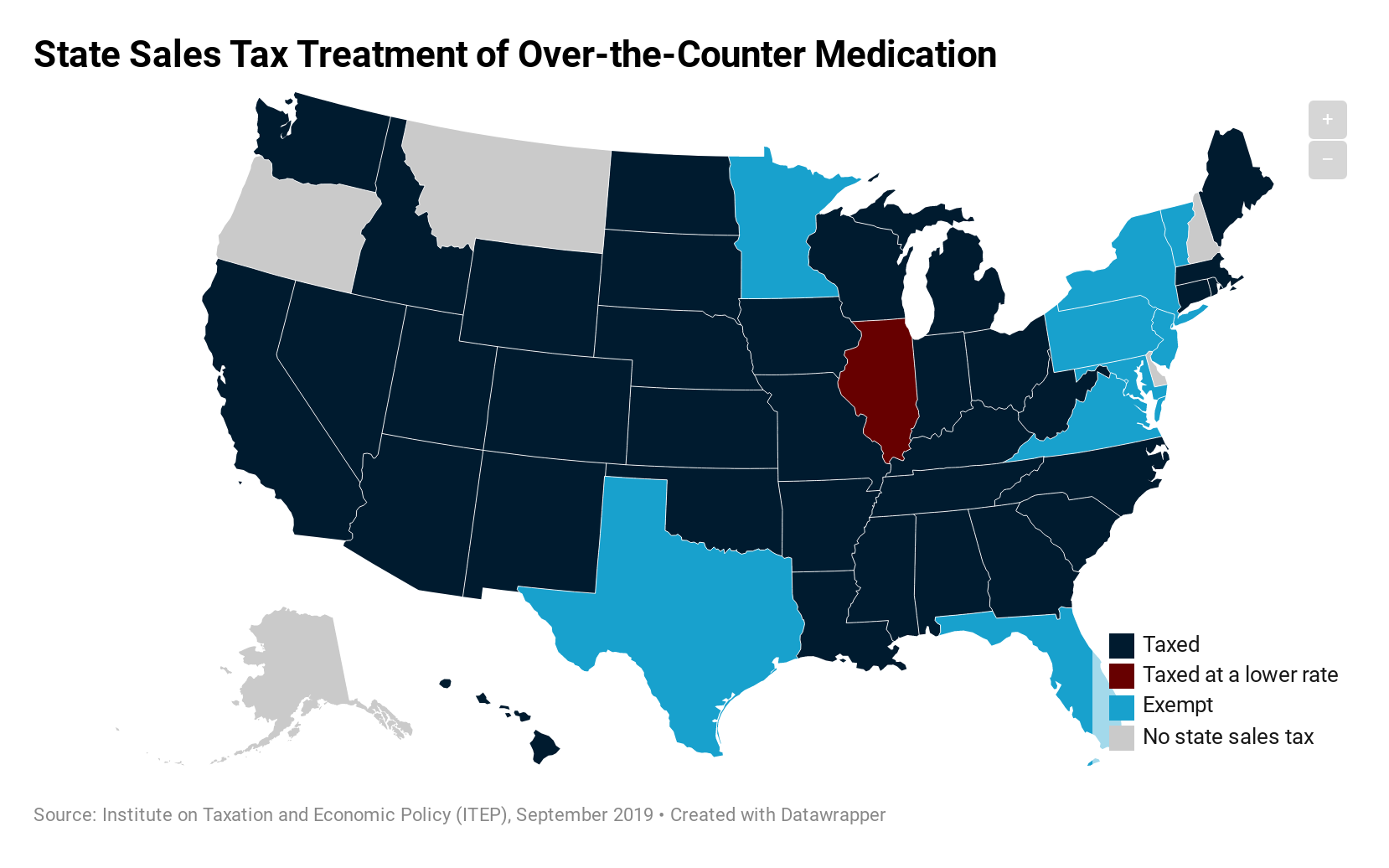

How Do State Tax Sales Of Over The Counter Medication Itep